Setting up a business account with SendCutSend is easy. We refer to our business accounts as ‘Organizations’, which enable employees to then benefit from their company’s tax exempt status, credit terms, and more.

To set one up for your company, email support@sendcutsend.com and then request to set up an Organization. Our team will be happy to help!

What is an Organization?

SendCutSend Organizations allow commercial customers to share access to your Net 30 account, tax exemption options, and NDA agreements. New users that share the same email domain will automatically be prompted to request approval to join your Organization. We aim to make adding users quick and painless so that you can stay focused on what matters most to you!

What can Organizations do?

Once an Organization is set up for your business, any employees who join the Organization can then automatically receive company benefits, such as

- Tax exemption

- Company wide NDA

- Access to credit terms if a company has them

- Requirement for PO (purchase order) at checkout

- DFARS password and security options like 2FA

If your company’s Organization has terms with SendCutSend, then your orders will be included in statements that are sent to your company’s billing department automatically.

Take a look at our step-by-step instructions for using Net 30 terms to initiate orders!

What can’t Organizations do?

Organizations cannot provide the following:

- Special permissions for one Organization member to administer other members

- Access to Organization member accounts for managers

- File sharing between Organization members

- Take a look at our Formal Quote and shared cart options instead

How can employees join existing Organizations?

We provide multiple ways for employees to join existing Organizations.

The fastest methods are:

- Company employees are invited to join the Organization when they set up an account.

- Organization members can invite their coworkers to join.

Check out our detailed instructions for how to join existing Organizations!

How do Organizations work in practice?

Let’s look at an example.

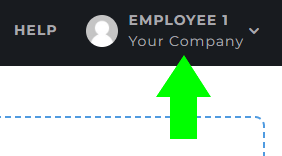

- Your Company is an Organization that has tax exempt status with SendCutSend.

- Employee 1 and Employee 2 both work at Your Company.

- They each set up individual SendCutSend accounts using their employee email addresses and then join the Your Company Organization.

- This allows them to order parts without being charged taxes right away; there’s no need for them to request tax exempt status individually.

In Summary:

To set up a business account for your company, email support@sendcutsend.com and state that you want to set up an Organization. Our team will be happy to help!